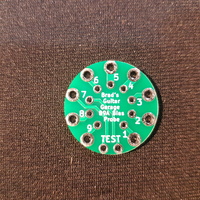

Featured products

USA CUSTOMERS:

ALL USA ONLINE ORDERS ON HOLD. CONTACT US VIA OUR CONTACT FORM TO MAKE AN ORDER.

NOTE: Your order may attract import duties / tariffs outside our control. Also, the suspension of the de minimis expemption on products under US$800, will result in additional costs and delays. Shipping times may also be unpredictable due to unprecendented processing challenges faced by customs. Brad's Guitar Garage will not be liable for any additional costs incurred. These additional costs must be paid by you, the customer upon importing. There's no further relaible information at this point, but we'll try to find out more as the situation develops.

Important notice: New US tariff rules for postal shipments – Effective 29 August 2025

The United States recently announced significant changes to its import tariff rules that will impact customers sending items from Australia to the US.

The changes are described in a US Executive Order. Australia Post is working closely with the United States Postal Service (USPS), US Customs & Border Protection (CBP) and the Australian Department of Foreign Affairs and Trade (DFAT), along with third-party platform partners, the Universal Postal Union (UPU) and other partners to ensure accurate information concerning the changes is shared with customers, and to provide updates as they are available.

Effective 29 August 2025, the key changes, are as follows:

- Suspension of de minimis threshold:

- The USD$800 exemption for low-value goods has been removed for postal and commercial sending.

- Mandatory customs declaration requirements:

- Every shipment from Australia to the US must include:

- Country of origin (COO) in your customs declaration and the manifest. For clarity, country of origin refers to the country of manufacture.

- Value of goods in your customs declaration and the manifest. This must be declared accurately for each item within your parcel.

- Harmonized System (HS) tariff code for each item in your customs declaration and manifest. It is your responsibility to ensure that the correct HS tariff number/s is used. You can use our auto-lookup or refer to the Department of Foreign Affairs and Trade website if entering manually.

- Every shipment from Australia to the US must include:

- Duties are to be collected prior to goods entering the US:

- US Customs & Border Protection has indicated that the duties and taxes will be collected on goods prior to entering the US. CBP has not yet advised the preferred method for duty and tax collection.

More information can be found here: https://auspost.com.au/business/shipping/parcels-international/international-post-guide/results/united-states#usa-tariff